Legal & Tax Updates [Back to list]

The BIR Now Prescribes the Use of Constructive Affixture of Documentary Stamp for Certificates Issued by Government Agencies or Instrumentalities

On 29 March 2023, the Bureau of Internal Revenue (“BIR”) issued Revenue Regulations No. 2-2023 (“RR 2-2023”) prescribing the use of constructive affixture of documentary stamp as proof of payment of Documentary Stamp Tax (“DST”) for certificates issued by government agencies or instrumentalities pursuant to the provisions of Sections 244 and 245 of the National Internal Revenue Code of 1997, as amended.

RR 2-2023 defined ‘Constructive Affixture of Documentary Stamp’ as the attachment of the original copy of the government official receipt issued by government agencies or instrumentalities evidencing payment of the DST on the taxable certificate.

Government agencies and instrumentalities will no longer use loose documentary stamps but will instead affix a constructive stamp on certificates subject to DST and collect the corresponding amount from the applicant. They will act as agents of the Commissioner of Internal Revenue for the collection and remittance of DST to the BIR. A single government official receipt may be used for multiple certificates, provided that the serial or control numbers and amount of DST are clearly indicated, among others. Moreover, the collected DST shall be remitted monthly through BIR Form No. 2000 and paid by the 5th day of the following month.

To ensure the maintenance of records thereof, it is required that government agencies and instrumentality keep a record of all government official receipts both in hard and digital copy. The record should contain the following details: (a) government official receipt series or control number; (b) serial or control numbers of certificates covered in the government official receipt (if multiple certificates were issued under one receipt); (c) date of issuance; (d) the applicant’s name for the certificate; (e) description of the certificate; and (f) amount of DST levied.

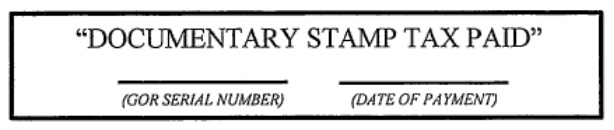

Moreover, government agencies and instrumentality must clearly and legibly stamp or print on taxable certificates “DOCUMENTARY STAMP TAX PAID,” with the official receipt’s serial number and date prominently displayed, as illustrated below:

A separate revenue issuance specifying the procedure for registration of government agencies and instrumentalities which plan to automate the imposition of the DST will also be released.